b&o tax wv

Sales and leases of motor vehicles aircraft watercraft modular homes manufactured homes and mobile homes. East Charleston WV 25301 3043488000.

City Of Buckhannon B O Tax Forms

Charles Town City Hall 101 East Washington Street Charles Town WV 25414.

. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by. The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities that impose the tax. Part of this is the ability to implement a local sales tax up to 1 in exchange for reductions in BO taxes.

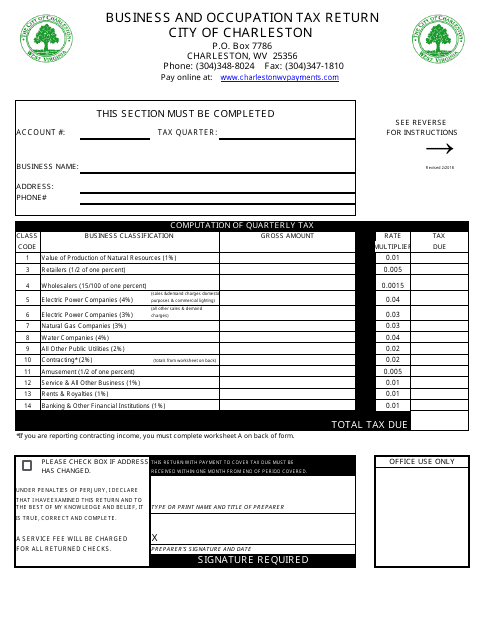

BUSINESS OCCUPATION TAX OVERVIEW. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Gross income or gross proceeds of sales derived from sales within West Virginia which is not taxed or taxable by any other municipality are included in the measure of Charleston BO Tax if the sales are either directed from a city location or if the taxpayers.

B O Tax. The City of Charleston broadly imposes a Business and Occupation BO Privilege Tax upon all persons for the act or privilege of engaging in business activities within the City of Charleston. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by.

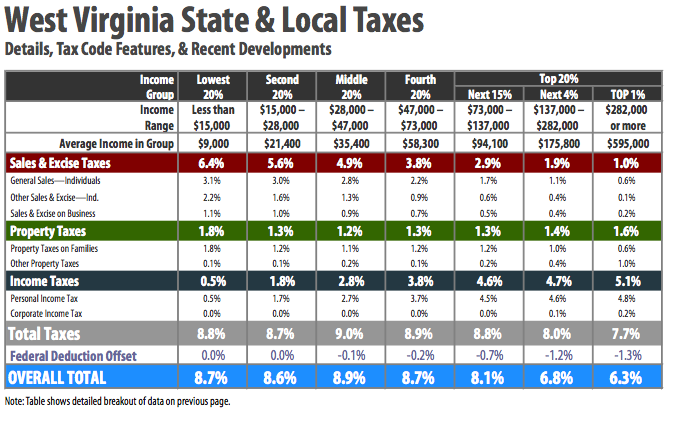

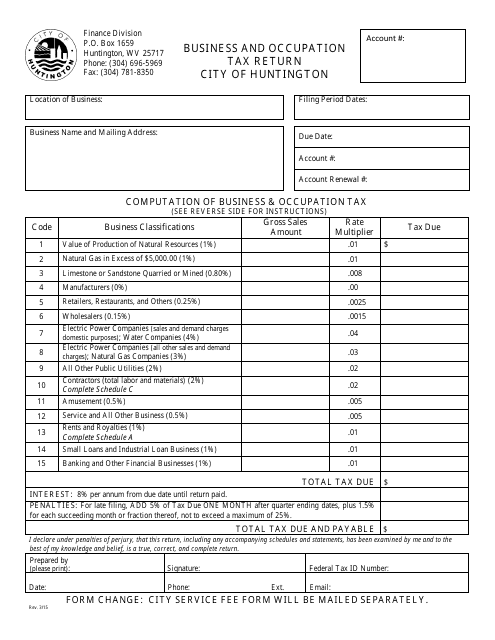

All businesses located in the Village of Barboursville must fill out the Business and Occupation BO Tax Return. The term business shall include all activities engaged in or caused to be engaged. The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits.

The Citys B O Tax is based on the gross income gross receipts of each business. You will list all gross income for the appropriate filing period on the return. BO Tax Returns must be filed quarterly.

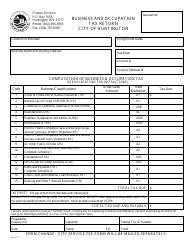

BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be. Business Occupation Tax. Municipal Sales and Use Tax Guidelines.

Charles Town WV 25414. Tax Return Form Businesses choose which way to submit Tax returns. Any business that is engaged in or caused to be engaged in activities with the object of gain of economic benefit either direct or indirect must file Business and Occupation BO Taxes.

The rates and tax base are determined by specified classifications based upon. Business Occupation Tax. Sales and uses of motor fuels that are subject to the motor fuel excise taxes imposed by W.

This legislation is effective July 1 2016. The rate per 10000 of gross revenue varies by business classification. Multiple business classifications can be filed.

You will list all Gross Income Sales for the appropriate filing period on the Return. Tax Information and Assistance. This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg.

Information on BO Taxes for Charleston WV. BUSINESS OCCUPATION TAX OVERVIEW. Code 11-14C-1 et seq.

The amount of tax is determined by the application of rates against values or gross income. Charleston West Virginia is a great place to live work and play. City of Fairmonts ordinance number 1655 with an effective date of October 8 2015 provides for the imposition administration collection and enforcement of a Consumers Sales and Service Tax and a Complimentary Use Tax of 1 on state taxable sales.

Businesses may also file and pay their taxes in person by visiting the City Hall address below. This tax is required to be reported quarterly and is due on or before 30 days from the quarter ending. Our City is always growing so use the information here to assist you.

Also effective July 1 2016 the City is reducing the Business and Occupation Tax rate on. Transactions such as satellite television which municipalities are. Business as used in the ordinance setting up this tax structure includes all activities engaged in or caused to be engaged in with object gain of economic benefit either direct or indirect.

PO Box 2514 Beckley WV 25802. The following general principles determine tax liability under the municipal BO Tax. Filing periods end on March 31 June 30 September 30 and December 31.

Steele says another reason to cut BO taxes goes back to a concept called home rule Cities in West Virginia can apply to be part of the Municipal Home Rule Program which gives those cities greater power to pass laws governing their jurisdiction. Should you need any assistance regarding BO taxes please call 304-725-2311 or email BusinessLicensecharlestownwvus. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records.

All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City of Charleston. The City of Clarksburg has business and occupation tax charged on gross revenues of every entity conducting business within the corporate limits of this municipality. 409 S Kanawha Street.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year.

Business Occupation Tax Clarksburg Wv

Wv Sales Pratt Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Wv Cities Worry About B O Tax Cuts

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

City Of Logan West Virginia New B O Tax Forms And Business License Update Forms Are Being Sent Out Beginning August 1st With The Revised Rates All Fees Will Be Due October

West Virginia Firefighters Share Concerns About Proposal To Slash B O Taxes Wowk

Wv Cities Worry About B O Tax Cuts

Wv Cities Worry About B O Tax Cuts

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

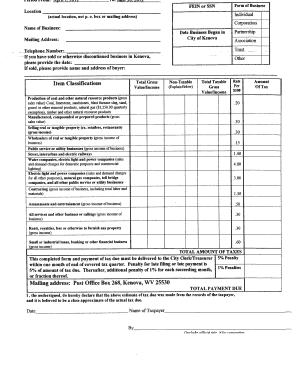

Kenova Wv B O Tax Form Fill Online Printable Fillable Blank Pdffiller